Technology And Big Data: Reinventing The Customer-Supplier Relationship

By Vele Galovski, VP Research, Field Services, Technology Services Industry Association (TSIA)

The marketplace for equipment manufacturers is rapidly moving from a pure product focus to a customer outcome-based focus. With this change, every manufacturer will be faced with the hard truth that their customers are changing the way they purchase. New customer expectations, new models, and new capabilities will put tremendous pressure on today’s field services organization to adapt, be relevant, and continue to deliver a key revenue stream for their company.

Understanding the new capabilities required in the future while continuing to deliver today’s results will separate the winners from the losers in field services.

Dismantling The Traditional Model

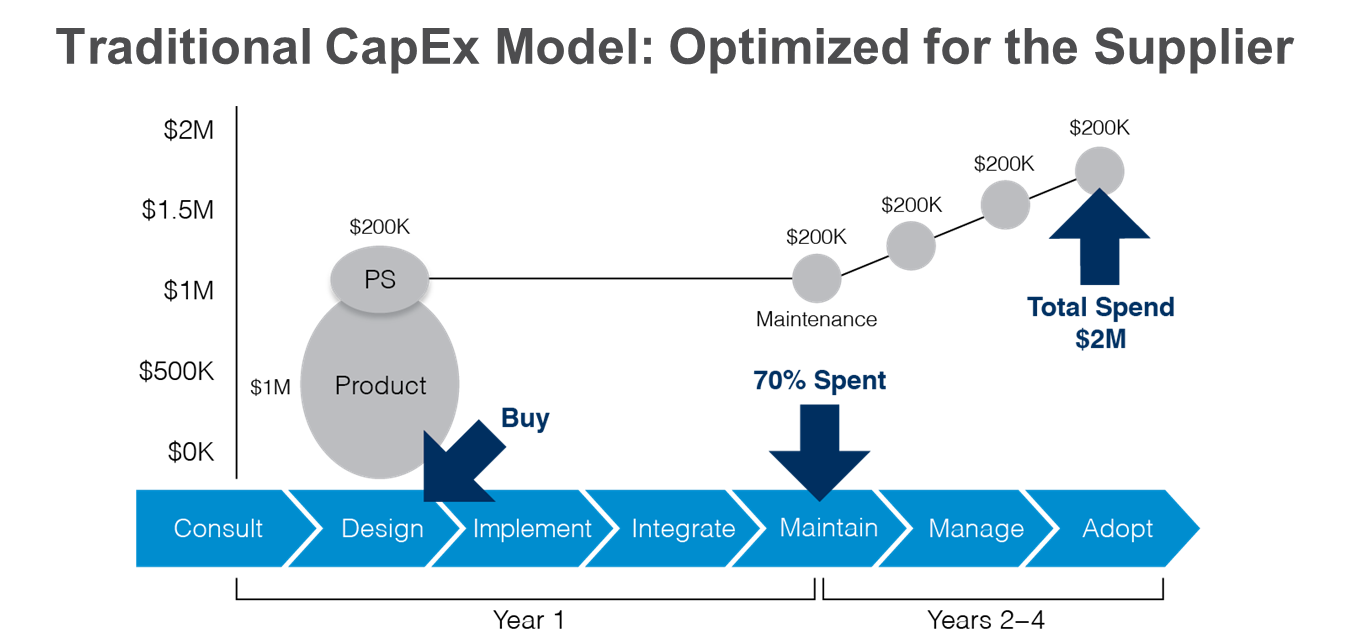

The traditional operating model of equipment manufacturers was designed to optimize a supplier’s “push” of prepackaged products to customers via large, up-front deals. The goal of this CapEx model was usually to get the maximum amount of product assets transferred from the supplier’s balance sheet to the customer’s balance sheet in one big order, with 70 percent or more of the total purchase price paid up front.

In addition to the large up-front costs, annual maintenance contracts were attached to the product which resulted in many field services organizations adopting a “get in, get out, and get to the next call” approach to maximize margins.

Unfortunately, these expenditures were only the beginning for the customer— implementation, configuration, and training services necessary to achieve full value of the product often resulted in deployment expenditures that are five to 10 times the cost of the product itself. With the suppliers receiving most of their revenue up front and the customer taking responsibility for achieving outcomes, there was a clear misalignment of risk and reward between customer and supplier.

Even though equipment manufacturers have successfully operated in this fashion for many years, there are two trends beginning to dismantle this traditional model. First of all, the value of the core technology asset is commoditizing, which is a well-known challenge to many hardware companies. Companies are just not achieving the same margins they once did when they sold a technology asset to the customer.

Second, in response to the misalignment of risk and reward, customers are pursuing new consumption models that do not involve a large up-front product purchase. This is forcing equipment manufacturers to create new ways to offer their technology, one where the customer pays as they consume. These two trends of commoditization and new consumption models are dismantling the historical economic engines of most technology companies.

The New B4B Model

TSIA believes that the supplier operating model is shifting away from product and toward the customer; away from the “make, sell, and ship” model and toward optimizing and delivering the outcome on behalf of the customer; away from the B2B age, where a manufacturer sold products TO a business customer, and toward B4B, where a supplier achieves an outcome FOR a business customer.

This is because customers are looking for their supplier to have some “skin in the game.” They want a supplier that will share the risk of the implementation and help them to achieve business outcomes from their investment. Playing an active role in optimizing the customer’s actual outcome will require field services organizations to fully embrace a different set of skills.

The added complexity for field services organizations is adding these new skills while continuing to provide ongoing support and maintenance services. These traditional services are, and will continue to be, a very important revenue stream for the company. Given the size of the revenue stream and the large cost associated with providing this service, support and maintenance services have the potential to be viewed as the funding mechanism for the organizational transformation. In this scenario, field services will continue to be squeezed for more productivity until service levels begin to suffer and the organization can’t give anymore.

But it doesn’t have to be that way. As the industry comes to grips with the changing environment, there will come a time when the CEO will realize that the company must drive for faster results on critical outcome-based KPIs only to discover that there is no gas pedal. We believe that now is the time to position the field services organization as having the core capabilities to be that gas pedal.

Delivering Today’s Results

Any significant disruption to the established way of conducting business brings problems that are easy to spot: continued cost pressures, having to do more with less, negative impacts on service levels, etc. Seeing opportunity in the disruption is a little tougher to identify. But, the change from a product focus to a customer-outcome focus in a B4B world changes the playing field for everyone, and nobody has an inherent advantage.

This is where the opportunity is. Field services leaders need to position their organization, their people, and themselves as leaders in the transformation by understanding, developing, and embracing these new skills and capabilities. Field services leaders must implement the right technology to capture data, provide proactive support, automate the mundane, and free up the most powerful asset in your organization—the brainpower in every employee. Leaders must also position their team to focus on outcomes and drive end-user consumption.

As we enter this era of business model disruption, TSIA firmly believes service organizations will find themselves at the epicenter of company success. The types of services may change from the traditional implementation, education, and support/maintenance offerings currently in the comfort zone of product companies. But successful service transactions will clearly be at the heart of market success. Service organizations must develop new organizational capabilities that will help lead their companies to market success. The time to start developing those capabilities is now.