Rugged Tablets Poised For Continued Growth In 2012

By Pedro Pereira, Field Technologies magazine

Experts discuss how the trend of consumerization and the role of Android will impact tablet adoption this year.

It was hard to escape the buzz around tablet PCs over the past year, as Apple’s iPad swooshed into the consumer market. And even though enterprise-focused tablets have been around for a decade, vendors believe continued buzz will drive tablet interest in the enterprise beyond industries where it already has a foothold — utilities, communications, and transportation.

It was hard to escape the buzz around tablet PCs over the past year, as Apple’s iPad swooshed into the consumer market. And even though enterprise-focused tablets have been around for a decade, vendors believe continued buzz will drive tablet interest in the enterprise beyond industries where it already has a foothold — utilities, communications, and transportation.

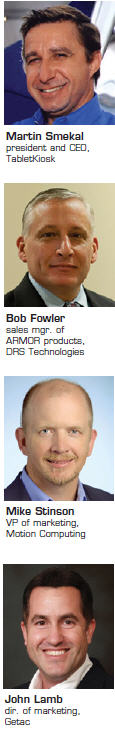

Counting on excitement to spill over to the enterprise, makers of rugged and business-focused tablets by and large are bullish on growth for 2012. Rugged tablets already are popular with field workers who leverage the mobility, functionality, and robustness of the devices to do their jobs. For 2012, vendors expect tablet technology will gain more traction in emerging sectors such as healthcare, construction, government agencies, the military, and retail. “Adoption will only continue to increase as businesses begin to figure out how they can incorporate a more intuitive, mobile device into their workflow that is also durable, flexible, and secure,” says Martin Smekal, president and CEO of TabletKiosk, a maker of rugged and media tablets.

Another company that expects 2012 to be a breakout year for tablets is DRS Technologies. According to Bob Fowler, DRS worldwide sales manager of ARMOR products, the increased popularity of the form factor will translate to substantial tablet sales in 2012.

Mike Stinson, VP of marketing at tablet maker Motion Computing, agrees 2012 will be the year of tablets in the enterprise. “Tablets will start showing up in places most people would have never imagined, such as during a home inspection, with a nurse at a patient’s bedside, on construction sites, or in your local department store,” Stinson says.

John Lamb, director of marketing for Getac, a maker of rugged notebooks and tablets, has a more moderate view of what is to come in 2012. People want tablets, he says, but they need to figure out what for. “There is an enormous amount of interest from IT folks, end users, and buyers,” Lamb says. “Most are still trying to determine how to integrate them into their working environment, but they already know they would like to use them. 2012 will be the year that begins to define what tablets will be used for and what they will look like.”

The Consumerization Effect

One of the major drivers of tablet adoption is consumerization, largely as a result of the iPad’s popularity. “For better or worse, tablets received lots of attention this year due to the continued unprecedented consumer adoption of Apple’s iPad,” says Smekal. “The launch of the iPad raised tremendous positive awareness of the technology in a staggeringly short amount of time, which is great for enterprise tablet manufacturers who have been catering to this niche industry for nearly a decade.”

A significant benefit of consumerization is that it provides an impetus to improve the form factor, say vendors. “Tablets will get thinner, the touch interface will get better, and battery life will get longer,” says Fowler.

Smekal says power, battery life, and security will be important themes in 2012. “As we do more on the go, and have increasingly robust devices from which to choose, we’ll come to expect more to support true productivity in the field,” he says.

Tablets also are starting to threaten the laptop’s dominance with mobile users. Fowler says ARMOR, which focuses on rugged tablets exclusively, has seen several major accounts switch to tablets from traditional notebooks. “The tablet form factor will take a huge bite out of the rugged notebook business in 2012,” he says. “Software optimized for touch interface provides faster input, and removal of a notebook keyboard decreases hardware failures.”

For that to happen, though, vendors must be attentive to customers’ specific requirements when designing the devices, says Stinson. “In today’s market, businesses expect devices to fit into their environments, not the other way around,” he says. “Businesses are looking for custom-fit solutions that are specifically designed for their environments and that can support essential software or productivity applications, have substantial battery life, and are powerful enough to support workflows.”

Tablets Penetrate Emerging Verticals

Lamb sees tablets today primarily as a consumer product, but that is changing. “Military, utilities, and insurance will likely be the three areas of growth in 2012,” he says. “Public safety will have some adoption, but that will likely push out to 2013.”

Smekal predicts rapid tablet adoption in the healthcare segment, which represents about 50% of TabletKiosk’s business. Driving that growth, he says, are federal mandates requiring the implementation of electronic medical record (EMR) systems by 2014 for healthcare providers to qualify for monetary incentives prescribed by the American Recovery and Reinvestment Act (ARRA).

Beyond healthcare, Stinson believes tablet adoption also will spread in the construction and retail sectors. “Mobile point of sale (MPOS) is on the rise, and it’s all about equipping sales people with the knowledge and tools to stay one step ahead of the customer,” he says. “Tablet PCs provide retailers with real-time access to information and transaction processing, meaning reduced abandon rates, empowered store associates, increased revenue per transaction, and improved inventory management.”

As new verticals gravitate toward the form factor, vendors also expect that field force automation in early-adopter industries to continue. They will want to take advantage of advancements in productivity, functionality, and design, vendors say.

Fowler says the fastest adoption so far has been in areas requiring “true service and mobile applications.” Power, gas, and communications companies, he says, were first to realize potential gains by replacing hardware used in the field with tablets.

How Will Android Factor In?

As 2012 kicks off, tablet vendors are keeping an eye on Google’s Android operating system with tempered expectations. Android requires rewriting software and creating new hardware drivers, which complicates adoption of the operating system. Fowler says a few ARMOR customers are using Android, but most are waiting to see how the product evolves and what lessons can be learned from early adopters.

Getac is seeing interest in both Android and Windows 8 by customers who are evaluating future use, Lamb says. “Concerns around Android have been the security of it in areas like the military. The military requires smartcard authentication for Windows systems, but typical Android tablets do not offer smartcard readers,” he says.

Stinson says rather than asking for a specific OS, Motion Computing customers are asking for devices that can seamlessly fit into their enterprise infrastructures. That characteristic, of course, should be the key factor in determining if a tablet is right for your company’s application.