Asset Tracking & Management

Asset tracking and management is an application that’s quickly gaining mindshare. Industry analyst Andrew Nathanson lets us know what to expect next.

Every enterprise has assets. It's a pretty obvious statement. What's not so obvious, however, is how companies can manage all of their assets. From laptops and servers to pallets and plastic totes, companies struggle to locate, identify, and ultimately manage the assets that exist throughout their enterprises. For some companies, a spotlight has been thrown on this problem due to Sarbanes-Oxley (SOX) compliance. For others, lack of asset visibility stands in the way of increased efficiency and production. In any event, technologies and applications have evolved that allow companies to get control of assets. The solutions almost always include complementary data collection technologies and software that converts this identification data into relevant information. Companies are now starting to wrestle this asset management issue to the ground. For insight on how the industry is evolving, we turned to Andrew Nathanson, director, AIDC (automatic identification and data collection) and RFID (radio frequency identification) practice, at Venture Development Corp. (VDC).

As an industry analyst, how do you define assets and related applications?

Nathanson: It's an interesting question, and one for which we've had to create a clear answer. For VDC, an asset is defined as a long-term, tangible item for business use that is intended to provide future benefit and is not expected to be converted to cash in the current or upcoming fiscal year. Applications pertaining to assets typically pertain to location-based services, tracking and utilization, and physical condition.

What growth have you seen in the asset tracking market over a defined period of time?

Nathanson: We've been monitoring the asset tracking market through our research, and our growth projections for the market are as follows: Asset tracking (all asset tracking technologies covered) had a CAGR (compound annual growth rate) of 27% between 2004 and 2007. Between 2006 and 2011, we predict that asset tracking will have a CAGR of 33.8%.

What markets are the most vigorous in adopting asset tracking solutions?

Nathanson: The vast majority of asset tracking activity occurring today is within markets that utilize high volumes of higher-valued assets deemed 'critical' to core business processes. Nearly 2/3 of all asset tracking initiatives are conducted within four vertical markets: transportation, healthcare, government, and automotive and aerospace.

In addition, growth for asset tracking in the United States is being partially driven by the need to be compliant with SOX, which requires publicly traded companies to have effective internal accounting controls in place.

Within those active markets, what types of assets need to be tracked that are driving adoption?

Nathanson: In most instances, asset tracking can be viewed as a horizontal application, providing the same type of function (and benefits) across nearly all vertical markets. Leading functions include tracking; RTLS/LBS (real-time location system/location-based services); and the sensing and monitoring of containers, shipping assets, vehicles, and equipment.

Assets being tracked within each vertical market include, but are not limited to:

Transportation

![]() Shipping containers/pallets

Shipping containers/pallets

![]() Equipment

Equipment

![]() Vehicles

Vehicles

Healthcare

![]() Equipment

Equipment

![]() Shipping containers/pallets

Shipping containers/pallets

![]() Vehicles

Vehicles

![]() Storage containers/bins/racks

Storage containers/bins/racks

![]() WIP (work in process)

WIP (work in process)

Government

![]() Equipment

Equipment

![]() Shipping containers/pallets

Shipping containers/pallets

![]() Storage containers/bins/racks

Storage containers/bins/racks

![]() Vehicles

Vehicles

![]() WIP

WIP

Automotive & Aerospace

![]() Equipment

Equipment

![]() Shipping containers/pallets

Shipping containers/pallets

![]() Storage containers/bins/racks

Storage containers/bins/racks

![]() Vehicles and completed product

Vehicles and completed product

![]() WIP

WIP

What identification technologies are being applied by enterprises to manage assets?

Nathanson: The primary technologies used for asset tracking include bar code labeling, direct part marking (DPM), and RFID. At this time, bar code and DPM dominate the asset tracking technology markets. These are established and field-proven technologies that are easily integrated into existing infrastructures without causing significant disruption or capital investment. Bar code labeling is the most widely used technology, except for those industrial and manufacturing environments that must use direct part marking due to a harsh labeling environment.

As RFID emerges as a viable alternative, it is redefining the value proposition of asset tracking technologies. In addition to the benefits provided by competing asset tracking technologies, RFID provides:

![]() additional visibility into asset life cycles and utilization

additional visibility into asset life cycles and utilization

![]() non-line-of-sight readability

non-line-of-sight readability

![]() longer read ranges and faster read rates

longer read ranges and faster read rates

![]() the capacity to add more functionality and tracking metrics via sensors, RTLS/LBS, and enhanced security and memory.

the capacity to add more functionality and tracking metrics via sensors, RTLS/LBS, and enhanced security and memory.

As prices continue to erode, performance increases and more functionality is integrated, the RFID asset tracking solution business model will dramatically improve, eventually becoming a 'best-in-class' option.

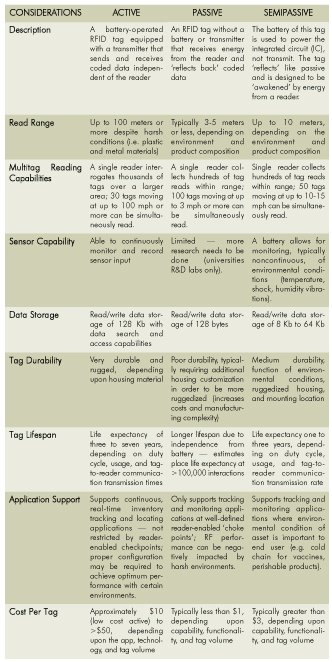

What roles do the various types of RFID (e.g. active, passive, semipassive) play in tracking assets?

Nathanson: The roles of these various RFID technologies within asset tracking really depend on the application and the deployment conditions. We've developed a grid (see below) that will help enterprises determine which RFID technology is best for their organizations.

What market shifts should enterprises anticipate in the next 12 to 18 months?

Nathanson: When we look at the asset tracking market, there are five key trends and developments that enterprises must be aware of as they proceed:

1. Further penetration of bar code and DPM solutions within brownfield and greenfield applications

2. Increased integration of asset tracking data with existing supply chain and asset management infrastructures and systems

3. Increased use of 'horizontal' off-the-shelf solutions capable of functioning within a diversity of markets and use environments

4. RFID implementations continuing to redefine asset tracking by providing increased functionality, value, and metrics

5. Increased penetration of RFID asset tracking solutions within tier-one accounts and communities

Andrew Nathanson is director, AIDC & RFID practice, at Venture Development Corp. (VDC). He can be reached at andrewn@vdc-corp.com. For more information on VDC, visit www.vdc-corp.com.